plans to bring your

vision to reality

Why should you have a Business Plan?

The need for a business plan can arise because of various factors. Here are some key reasons why creating a business plan is essential and how to acquire a business loan.

Business loans for buying a business

To outline the business idea, goals, and qualifications for a business loan.

Securing Financing Options

To present to investors or banks when seeking loans or investments.

Applying for a business grant & subsidy

To present to the government for a potential subsidy or grant.

Market Analysis

To understand the market, competitors, and target audience

Attracting Partners

To convince potential partners or collaborators of the business’s viability.

Business Plans

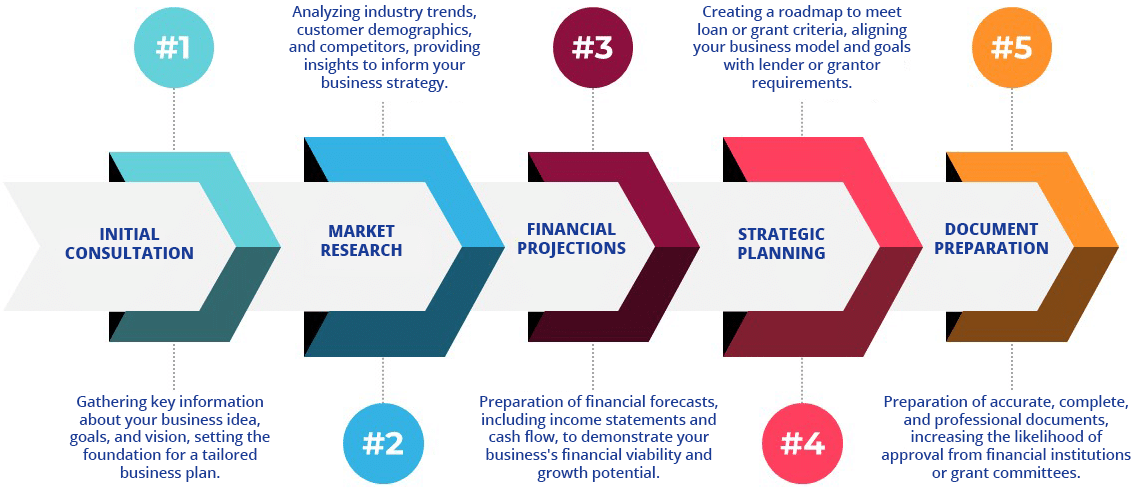

The process

Frequently Asked Questions (FAQ)

1. How do business loans work?

Business loans provide funds to help businesses cover expenses like equipment, operations, or expansion. Financial institutions, like banks and credit unions, look at factors such as annual revenue and credit reports. They also check personal credit scores to decide if a business is eligible.

Depending on the lender, loan terms can vary in duration, amount, and interest rate. Business loan requirements often include providing a business plan, bank statements, and proof of income.

Getting business financing means deciding between short-term loans and long-term loans. Lenders charge higher interest rates for short-term loans, but borrowers pay them back quickly. Long-term loans have lower rates but take longer to repay.

2. How to get a business loan with no money?

Getting a business loan with no upfront capital can be challenging, but it’s possible. Lenders may look for collateral, such as personal assets, or a strong personal credit score to offset the lack of cash. To get business funding without money, you may need to show steady annual revenue. You can use bank statements or a strong business plan to accomplish this.

Small business owners often consider alternative financing, like microloans or government programs, which may have less strict requirements. Be prepared to face higher interest rates, as lenders may view this type of loan as riskier.

3. What is the business lending criteria in Canada?

Business lending criteria in Canada vary depending on the lender but typically include:

Annual Revenue: Lenders assess your business’s income to determine repayment ability.

Credit Report and Personal Credit Score: A good credit history is crucial for approval.

Personal Assets: Some lenders may require collateral to secure the loan.

Bank Statements: These show cash flow and financial stability.

Business Loan Requirements: You may need to provide a detailed business plan and tax returns.

Traditional banks often have stricter requirements compared to private lenders or financial institutions.

4. How to buy a business in Canada with no money?

Buying a business with no money typically involves creative financing strategies:

Seller Financing: The seller agrees to finance part of the sale, reducing upfront costs.

Leveraging Personal Assets: You can use property or savings as collateral to secure a loan.

Alternative Lenders: Financial institutions offering short-term loans may accept higher interest rates for quicker approvals.

Partnerships: Partnering with an investor can provide capital in exchange for equity.

To improve your application, you need a good personal credit score. You should also have a strong business plan. Lastly, provide proof of your business's yearly revenue.

5. What are the types of business loans in Canada?

In Canada, business loans include several options:

Term Loans: Offered by traditional banks, these are long-term or short-term loans for specific business needs.

Lines of Credit: A flexible option for covering operational costs.

Government-Backed Loans: Designed for small business owners, often with lower interest rates and lenient credit requirements.

Equipment Financing: Loans specifically for purchasing machinery or tools.

Merchant Cash Advances: Based on future sales but often come with higher interest rates.

Depending on the lender, requirements like a strong credit report, consistent annual revenue, and bank statements may apply.

Hi, I'm Yousef